ECONNED – The Movie, Um, Video!

A very talented movie/commerical/trailer editor, who for some bizarre reason insists on going nameless (but if you want his coordinates, don’t hesitate to ping me) assisted by Ben Fisher in a major role (finding images and video clips) and Richard Smith in a minor role (extensive sanity checking) put this together.

This may inspire McLuhan-esque debates, since I wanted something true to the medium, as in visceral and immediate, rather than the usual talking head sort of piece.

Enjoy! Oh, and turn the sound up

Friday, March 12, 2010

ECONNED -– The Movie, Um, Video!

Awsome video from Yves Smith!

Labels:

banks,

crash,

crisis,

depression,

economics,

finance,

Government,

John Maynard Keynes,

markets,

money,

obama,

order,

panic,

politics,

power,

recession,

republicans,

wall street

Tuesday, February 16, 2010

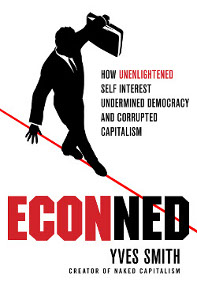

Buy this book! Econned: How Unenlightened Self Interest Undermined Democracy and Corrupted Capitalism

Make sure you get the upcoming book from my friend Yves Smith of www.nakedcapitalism.com fame.

Countdown 3/2/10: Excerpt from Econned

Folks, the time has come when I must start shamelessly promoting my book, Econned: How Unenlightened Self Interest Undermined Democracy and Corrupted Capitalism, which is being released March 2, 2010.

I thought the extract below would give readers an idea of what the book is about, with one caveat. Econned goes into some detail about crisis mechanisms (as in why it got as bad as it did) and has unearthed a heretofore unexamined hedge fund trading strategy that turned the subprime mania into the detonator of the global debt bomb (and yes, we have the goods).

Enjoy!

In 1776, Adam Smith published The Wealth of Nations. In it, he argued that the uncoordinated actions of large numbers of individuals, each acting out of self-interest, sometimes produced, as if by “an invisible hand,” results that were beneficial to broader society. Smith also pointed out that self-interested actions frequently led to injustice or even ruin. He fiercely criticized both how employers colluded with each other to keep wages low, as well as the “savage injustice” that European mercantilist interests had “commit[ted] with impunity” in colonies in Asia and the Americas.

Smith’s ideas were cherry-picked and turned into a simplistic ideology that now dominates university economics departments. This theory proclaims that the “invisible hand” ensures that economic self-interest will always lead to the best outcomes imaginable. It follows that any restrictions on the profit-seeking activities of individuals and corporations interfere with this invisible hand, and therefore are “inefficient” and nonsensical.

According to this line of thinking, individuals have perfect knowledge both of what they want and of everything happening in the world at large, and so they pass their lives making intelligent decisions. Prices may change in ways that appear random, but this randomness follows predictable, unchanging rules and is never violently chaotic. It is therefore possible for corporations to use clever techniques and systems to reduce or even eliminate the risks associated with their business. The result is a stable, productive economy that represents the apex of civilization.

This heartwarming picture airbrushes out nearly all of the real business world. Yet uncritical allegiance to these precepts over the last thirty years has produced a world in which corporations, especially in finance, are far less restricted in their pursuit of profit. We show in this book how this lawless environment has led the financial services industry to pursue its own unenlightened

self-interest. The industry has become systematically predatory. Employees of industry firms have not confined their predation to outsiders; their efforts to loot their own firms nearly destroyed the industry and the entire global economy. Similarly destructive behavior by other players, often viewed through a distorted lens that saw all unconstrained commercial behavior as virtuous, added more

fuel to the conflagration.

Some economists have opposed this prevailing ideology; indeed, comparatively new lines of inquiry focus explicitly on how economic actors can fool themselves or others into making poor, even destructive, choices.

But when the economics profession has used the megaphone of its authority to dominate discussions with policymakers and the public, it has spoken with one voice, and the message has been the one described here. We therefore confine our criticism to these particularly influential ideas.

Theories that fly in the face of reality often need to excise inconvenient phenomena, and mainstream economics is no exception. Idealizing the rational aspects of business decisions means refusing to notice behavior that is predatory, destructive, criminal, or simply stupid. Believing that risk is manageable through mechanical systems has required not just unrealistic assumptions but also willful

blindness to clear signs of danger.

We offer here another point of view. This book lays bare both the actions leading to the credit crisis and the economic constructs that defended, facilitated, and even exacerbated this behavior. Our case makes clear that if our economic system is to harness the self-interest of individuals to achieve the general

good, it must be supervised within a democratic society and responsive to criticism by outside voices of those who are unafraid to think independently.

Tuesday, January 26, 2010

Neither Keynes nor Hayek would be happy

Since Obama seems hell bent on doing exactly the wrong thing at the wrong time, namely proposing a spending freeze while jobs are still being lost, as expounded on by Marshall Auerback , here is a little background as to why this is not good by John Carney of the Business Insider:

Labels:

democrats,

depression,

economics,

Friedrich Hayek,

John Maynard Keynes,

obama,

politics

Subscribe to:

Posts (Atom)